Executive Condos (ECs) in Singapore are designed for middle-income families and professionals, offering a balance between affordability and upscale condominium living. To qualify for an EC, applicants must be Singcitizens or permanent residents, have a total household monthly income not exceeding S$14,000, and not own another flat in the past five years. Additionally, they cannot have purchased an EC, private condo, townhouse, or executive apartment within the last 30 months. The application process for ECs involves a ballot system if demand outstrips supply, with successful applicants proceeding to select their unit from those compliant with income and occupier eligibility criteria. Applicants must provide complete documentation, including proof of income and identity, and adhere to the resale requirements and lease terms for future sale considerations. Prospective buyers should also explore housing loans tailored for ECs, considering various financing options and interest rates to find a sustainable mortgage repayment plan within the income ceilings set by the government. Staying informed on the latest changes in EC requirements and application procedures is crucial for a successful application and smooth transition into home ownership.

navigating the path to homeownership in Singapore, understanding the unique attributes of an Executive Condo (EC) is a crucial step. These hybrid properties offer a blend of benefits for eligible applicants, blending the features of public and private housing. This article demystifies the Executive Condo application process, detailing the eligibility criteria, application steps, required documentation, and financing options. Whether you’re considering an EC for its attractive pricing or potential upgrade path to a fully privatized condominium, this guide will equip you with the knowledge to make informed decisions in your pursuit of a new home.

- Understanding the Unique Nature of Executive Condos in Singapore

- Eligibility Criteria for Applying for an Executive Condo

- Step-by-Step Guide to the ECO Application Process

- Documentation and Paperwork Required for Executive Condo Applications

- Financing Your Executive Condo: Mortgage Options and Considerations

- Post-Application: What to Expect During the Selection and Allocation Process

Understanding the Unique Nature of Executive Condos in Singapore

In Singapore, Executive Condominiums (ECs) serve as a unique housing option designed for professionals and families who aspire to own a larger and more affordable property than what is typically available in the private condo market. Unlike traditional HDB flats or private condominiums, ECs cater to a specific group of residents: couples must be Singaporean citizens and either party must not currently own or have disposed of another flat within the preceding five years. This eligibility criterion ensures that the EC scheme effectively targets those at a different stage of their property ownership journey compared to public housing or private condominiums. The application process for an EC is tailored to reflect these unique requirements, with applicants needing to meet the Singaporean citizen criteria as well as income ceilings set by the Housing & Development Board (HDB). Prospective buyers must also satisfy the resale levy (RL) and must not own any other residential property at the time of application. This combination of factors makes the Executive Condo a distinct and attractive proposition for eligible Singaporeans looking to upgrade from public housing or seeking an alternative to private condominiums, offering a balance between affordability and the benefits of condo living.

Eligibility Criteria for Applying for an Executive Condo

When considering the application process for an Executive Condo (EC), it’s crucial to understand the eligibility criteria as they are a unique class of housing in Singapore designed for middle-income families. To apply for an EC, applicants must meet specific requirements. Singcitizens or permanent residents who are married and both individuals hold a Singaporean identity must apply jointly. Additionally, applicants cannot already own or have an outstanding flat from the Housing & Development Board (HDB). Furthermore, the applicant’s total monthly household income should not exceed S$14,000. This income ceiling is subject to guidelines set by the CPF Board, and it’s important to refer to their latest regulations for accuracy. Applicants must also not have applied for, or owned an EC, private condominium, townhouse, or executive apartment within the past 30 months. These stipulations are in place to ensure that the Executive Condo scheme benefits those who are truly within the target demographic, aligning with the broader goals of Singapore’s public housing policies. Prospective buyers should carefully review these criteria and assess their eligibility before proceeding with an application to avoid any complications during the application process.

Step-by-Step Guide to the ECO Application Process

To purchase an Executive Condo (EC) in Singapore, a prospective buyer must first navigate the specific application process set out by the government. The application for an EC is open to Singapore citizens or permanent residents who meet the following eligibility criteria: they must be at least 21 years old, have a minimum household income of SGD5,000 per month, and cannot own another flat at the time of application. Eligible applicants can apply for an EC through the Housing & Development Board (HDB) or the relevant Certified Financial Institutions (CFIs).

The application process begins with a ballot system where applicants submit their applications during the sales of flat units. Successful ballot participants are then invited to book a unit. The application form must be accompanied by the required documents, such as proof of income, identity documents, and financial paperwork. Upon successful booking, the applicant enters into a legally binding agreement with the HDB or CFI, which outlines the terms and conditions of the purchase. Throughout the application process, it is crucial to adhere strictly to all guidelines and deadlines to avoid disqualification. Prospective EC owners should also familiarize themselves with the resale requirements and lease terms, as these will apply if they decide to sell the unit in the future. Understanding the Executive Condo requirements is essential for a smooth application process, ensuring that applicants can successfully secure their desired home.

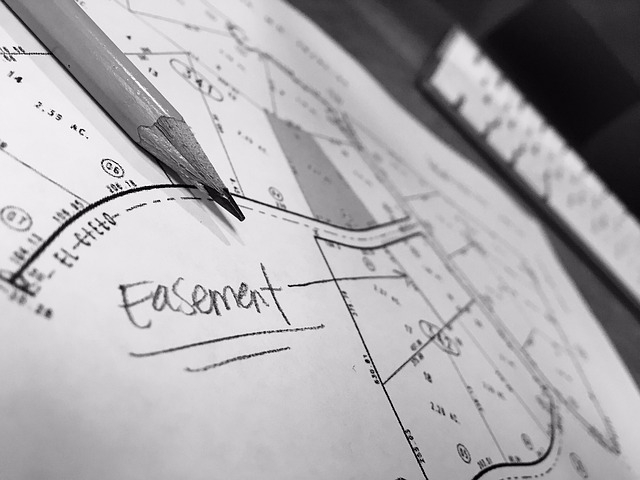

Documentation and Paperwork Required for Executive Condo Applications

When contemplating the application for an Executive Condo (EC) in Singapore, potential buyers must be well-versed with the documentation and paperwork required to facilitate a smooth application process. The Housing & Development Board (HDB) outlines specific EC application requirements that applicants must meet. Prospective buyers are required to submit a complete set of personal particulars, including the SingPass account details for all flat owners or intending flat owners. Additionally, proof of income and financial documents such as recent salary slips or computations for self-employed individuals will be necessary. For Singaporeans buying an EC, the CPF (Central Provident Fund) allocation limit must be observed, and the required CPF savings must be in place. Couples looking to apply must ensure that they have been married for at least 3 years to qualify under the Public Housing Scheme. Furthermore, all applicants must satisfy the income ceiling set by the National Development Minister to be eligible for an EC. It is imperative to provide accurate and complete documentation to avoid delays or rejection of the application. The Executive Condo Requirement stipulates that all applications must be accompanied by these documents, which include but are not limited to application forms, financial documents, proof of identity, and marital status certifications. Ensuring that all paperwork is in order before submission will enhance the chances of a successful EC application.

Financing Your Executive Condo: Mortgage Options and Considerations

Navigating the Executive Condo (EC) application process includes understanding the various financing options available to prospective owners. Securing a mortgage for an EC is a critical step, and applicants must familiarize themselves with the specific requirements set forth by financial institutions. The Singaporean government has tailored housing loans for ECs, which come with their own set of terms and conditions. These include the maximum loan-to-value (LTV) ratio and the requirement for a minimum down payment. It’s advisable to compare different mortgage packages from banks and finance companies, taking into account factors such as interest rates, tenure, and early repayment penalties. Additionally, potential buyers should assess their financial situation thoroughly to determine an affordable and sustainable monthly mortgage repayment. Prospective EC owners must meet the Executive Condo Requirement in terms of income ceilings and housing policies to be eligible for a loan. By carefully considering these aspects and staying informed about the latest financing options, applicants can make prudent decisions that align with their long-term financial goals.

Post-Application: What to Expect During the Selection and Allocation Process

Once your application for an Executive Condo (EC) has been submitted, prospective homeowners enter a selection and allocation process that is both structured and competitive. After the launch of new EC projects, the Housing & Development Board (HDB) will conduct a ballot if the demand exceeds the supply. Applicants who are selected through the ballot will be notified, and they will have a set period to respond and indicate their interest in specific units. It is imperative to act promptly during this phase as failure to do so may result in forfeiture of the unit allocation.

For those fortunate enough to be selected, the next step involves the selection of their preferred unit from those available. The HDB will provide a list of units based on the applicant’s preferences indicated during the application process, which should align with the Executive Condo requirements such as household income ceilings and occupier eligibility. Upon successful selection of a unit, an option fee is payable to reserve the unit. The allocation process culminates in the signing of a lease agreement with the HDB, after which the keys to your new Executive Condo will be handed over, marking the beginning of your journey into home ownership. Throughout this process, it is crucial to stay informed about any updates or changes to the EC requirements and application procedures to ensure a smooth transition.

navigating the application process for an Executive Condo (EC) in Singapore involves a clear understanding of its unique attributes, meeting the eligibility criteria, and adhering to specific application steps. Prospective applicants must be well-versed with the documentation required and the various mortgage options available to finance their ECO purchase. This comprehensive guide has demystified the Executive Condo requirement and application journey, ensuring that aspirants are well-prepared for the selection and allocation process. By following these steps meticulously, applicants can confidently proceed towards owning an ECO, a valuable asset in Singapore’s vibrant real estate landscape.